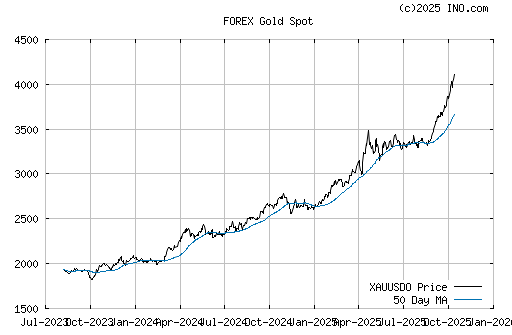

Gold hit a all time nominal high on Friday as well at $1,415.35 per ounce. Despite all the mainstream media pundits screaming that gold is in a bubble the price continues to rocket higher. I even heard Erin Burnett from CNBC say the other day that she was looking at gold coins online. This being the same Burnett that used to laugh at goldbugs. Well keep laughing biaatch.

I would hate to tell people to get into a market this late in the game. Were gold and silver simply like other stocks then I would advise that people buy with one hand and hold the sell button with the other hand. However, the US government and federal reserve are being extremely reckless with their management of the US dollar. They continue to abuse it with $1.4 trillion dollar deficits, $500 billion dollar deficits, multi-trillion dollar money printing a.k.a quantative easing campaings and zero percent interest rates. So long as these conditions continue its not gold and silver that are at risk of collapse in price but the DOLLAR! There is no limit to how high silver and gold can go nominally when the medium of exchange falls apart and loses all value.

The reality is that people should not buy gold and silver to become rich or make money. These metals have no function other than as monetary instruments. You buy gold and silver to preserve your purchasing power and protect your wealth from the lunacy of the powers that be. What if the USD does not utterly collapse but instead loses 70% of its value? Would you be happy with that? Why let the assholes that be rob you of your hard earned wealth? This is why you MUST exchange your paper notes for true and historical money, and not the digital fiat bullshit that's been flying around for the past 39 years.

New job update: TTToilet law hero but its a great place to work at. My boss is super cool, smokes cigs with me as do several other staff. On Friday at around 4:00 pm he told us all to get "the fuck out of the office its FRIDAY". He's in his upper 30's and is a ton of fun. The work is personal injury accidents that come in from all over the place. My job is to settle the cases with defense counsel and with the insurance adjusters in the pre litigation phase. Of the 90 files under my management, some of them are $100,000 settlements. Some are small 10k in meds, but make for quick settlements and income to the firm. My bonus structure is pretty cool. Tons of mediations, depos, arbitrations, TSC's, MSC's and discovery work (blah). The clients range from doctors to blue collar workers to military to homeless. One recent case file has a client who served in Iraq twice. So long as I don't get shit canned for one reason or another I plan on staying at this place for a few years. The hours are no more than 50 per week and will be making a good 60-70k with bonus, depending on how many cases I can close. Not too shabby. So I can say from experience that not all small law firms are shitlaw. Good environment, friendly staff and boss, and decent pay with reasonable hours.

Thats all for now.

How do you feel about companies whose sole business is in Silver/Gold, like Silver Wheaton (SLW) or Goldcorp (GG)? I've heard there are weird tax rules if you buy a gold/silver ETF. Do you think it's better to buy the actual metals, as opposed to owning them through securities? I've heard of people doing that, but I just always think that sounds like something the Armageddon/conspiracy/bomb shelter crowd would do.

ReplyDeleteAwesome on the job, man.

J-Dod:

ReplyDeleteI only buy physical gold and silver. If you want to hold some physical silver you should look at silver eagles or libertys. I don't trust ETF's such as SLV and GLD. These instruments are good to trade but if you want true insurance on your money then I recommend buying the real thing.

As to buying gold/silver miner stocks I don't bother with these. Of course you can make/lose alot of money with individual companies. Just make sure you do your due diligence as stocks can rise and plummet with alarming speed. I can say with clarity that I know my silver coins will ALWAYS have value as they always have had value while a company can get bought out or go under due to market competition or executive fraud via accounting buggery.

Subprime:

ReplyDeleteYour a finance guy. There obviously must be funds which aggregates private student loans (non-govt guaranteed) sold on the open market. And, one would think that there must also be derivatives associated with these investments. Please, please, please find me a credit default swap derivative so I can get paid when all these private placed law school loans go bust. Yes, I realize they are non-discharge, but so are alot of other debts and they are an absolute cluster for the lender to collect on too. If it is not happening already I expect that the yields on those student loan pools are going to be non-performing and continue in that trend for years.

Bobbyfoozball:

ReplyDeleteThe best way to make some coin off of the demise of the student loan diploma mill cartel is to short the education stocks such as corinthian college, ITT tech, apollo group, devry, et al. However, Corinthian is already down like a bastard, i.e. from $19 to $4.24 since August. Since I dont have a series 7 i cannot give investment advise. However, what you can do is do some research on some private university law school bonds and sell them short.

And you are correct by stating that even though law school loans are nondischarge, it hurts the schools FUTURE ability to issue bonds as investors will see past performance and imply that to the future.

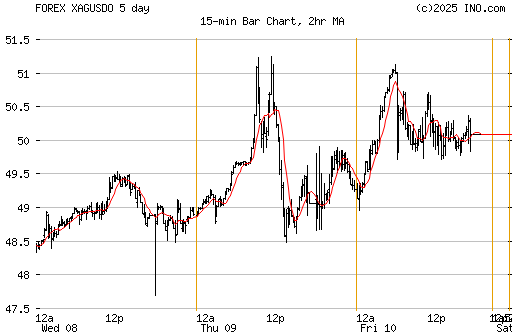

On a unrelated note, observe silver as it just popped through $30 per oz ahahahahahahahahahahahhahahahahaha

What is your turning point, signal for the trend going down?

ReplyDeleteI'm positive gold is in a trend upwards, but for how long?

There are all kinds of reasons (world economics, obama, problem nations, etc).

Anyway, gold will go up until... what?

what are your reasons or 'things' that will happen to make gold bubble bust and start trending down.

I'm learning from this to make my decisions:

http://www.goo.gl/17t4I

(that is a google short url link)

So, what are things that will make you change your mind about buying gold and start selling it?

just trying to plan ahead :)

thanks

US has a structural deficit that runs in the trillions;

ReplyDeleteOvernight rates are at zero;

The fed is currently conducting QE2 and has already hinted at QE3, Bernanke is LYING when he says that the fed is not printing money because it is;

Obama has announced extended tax cuts and payroll tax holiday. This measures will add an ADDITIONAL $5 Trillion in debt over the next decade. How much more abuse can this nation's federal balance sheet take??

Until I see that the US budget in line with tax revenue, gold and silver will continue to rise. Remember that Paul Volker raised the fed funds to 16% in 1980 to break the back of inflation. After rates were raised so high the dollar rose and gold/silver fell.

Basically, when you see our gov leaders start taking responsibility with the nations currency and finances by plugging the deficit and by raising rates, then the sell signal for precial metals is there. However, if the current recklessness prevails and continues then I fear there is no limit to how far down the dollar can go. Look at crude oil and how it popped to $90 most recently. That is ominious for the economy even though the bastards on MSM will never say it.

Here is some analysis from Chris Martenson, my favorite analysis on the "money" issue. He fears that we will experience a hyperinflationary outcome or a really bad bout of inflation. The difference between the two is huge. Anyways, here is the excerpt:

"Another form of money that we like to keep our eye on is not precisely money, because it is not in circulation, but is more accurately a future source of credit. Here’s what I mean: Banks make loans based on reserves they hold – this is the essence of fractional reserve banking. We like to keep track of these reserves from time to time so that we can assess how much credit might become available in the future and thereby contribute to another bout of economic growth and/or inflation.

As you probably know, bank reserves have been growing by leaps and bounds as the money given to them by the Fed (for various assets, troubled and otherwise) gets redeposited at the Fed. One measure of this is known as the ‘adjusted monetary base,’ which is the sum of all bills and coins in circulation (just under $900 billion) plus all the excess reserves on deposit at the Fed."

http://www.chrismartenson.com/martensonreport/dont-be-fooled-inflation-upper-hand

I hear you and am on board with you to an extent about metal and other commodities. Personally, Silver seems like a better bet for most people, as it is significantly cheaper than gold right now. I was reading somewhere that silver is usually 1/16 the price of gold, and currently it is far cheaper. This is another interesting way to look at the devalued rate of the dollar, as gold prices seem to be driven artificially high given the huge demand generated by doom-sayers offering to sell you gold before the apocalypse. Personally, I'd rather have a good rifle and reloading bench if we're talking the end of the world. Either way, it seems as if it makes sense to buy Asian currencies as well, as they are projected to hold value better than the dollar in the short run and are much cheaper than gold.

ReplyDeleteAlthough for me, the question is moot. I'm still in my 2L year surviving completely off of government loans, so I have no capital to invest either way.

Subprime, where do you go to obtain silver eagles or libertys?

ReplyDelete