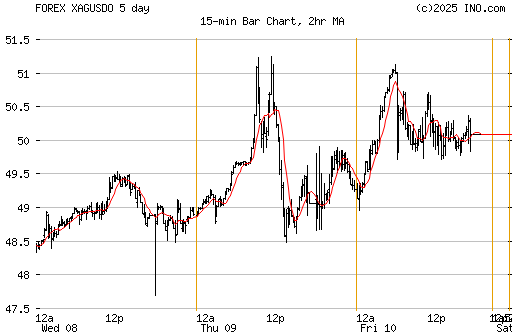

Observe the carnage in the April contract:

And then there is my good friend silver which has continued to defy gravity and has just broken the $34 mark. I hope and pray for the silver price to crash so we can buy more at a cheaper price. Ladies and gentlemen, observe one of the greatest bull markets in the making despite the fact that the retail (read: dumb money) investor has barely participated in this run up. Just go to any mediation and start asking around if any of the dimwit judges or lawyers have any silver in their portfolios and they will look at you like you're some type of alien. Well too bad for them ahahaha.

Since my last post on Friday discussing the silver price bonanza the shiny metal has gained 5.2 percent! Personally I hate buying any asset class during the rips and prefer buying on the dips.

There are many reasons why silver has been performing in the manner it has in the past few days. The video below explains how JP Morgan Chase has been selling short silver contracts via the New York Federal Reserve bank. Yes, the NY Fed has been using JPM as a proxy to beat down the silver price.

In addition, the historical gold to silver price ratio has been 15. With gold trading at $1,408, based on this metric, silver should be trading at $93! When the public finally wakes up to the fact that their fiat digital currency is being rendered into confetti by the all wise Ben Bernanke, I expect the historical ratio to reappear.

Lastly, this message is for the law class of 2010. I know there are many of you that are unemployed, diligently combing the internet for jobs, sending out resume upon resume in the hope of getting a job. By now given that it is February and nearly 1 year since graduation the frustration and stress must be growing. Do realize that you are not alone and that there are thousands of others facing a similar challenge. This is the despair phase as the resume gap grows alongside with the student loan balance. My advice for you is to keep looking for work, if possible get a part time job to keep you occupied. Go to a park, the mountains, anything you can to get outdoors (for cheap) to get your mind off the constant stress of your financial situation.

Most importantly, however, I would advise you to seek out like minded individuals who are experiencing the same trouble that you are. A few years ago these online communities did not exist while today they are flourishing with more and more visitors. Confess your burden and you will feel some of the weight drop from your heavy heart. And do realize that ironically, the more people that graduate with these insanely high levels of debt, the closer we all are to the end of this disgusting game. Already, people are posting comments with words such as “revolt” or “revolution.” I believe that by the time the class of 2012 will be several months out of graduation that the outcry will grow so loud that some reform will begin to take place. For now what we can do is begin to prepare, organize and develop strategies as to how we can tackle this beast. The culprits are listed as follows: the ABA, the law schools, the bankruptcy courts and CONgress.

While the powers that be want us to believe that they are all powerful and that it is futile to resist them, recent events in the middle east have proven otherwise. The dictators of Tunisia and Egypt have been toppled while Libya’s Gaddafi teeters on the verge of collapse. Protestors in Yemen, Morocco, Algeria and Bahrain have also battled police in their struggle for a better life. While we here in the US enjoy many more freedoms than these people ever had, our freedom is slipping away on a daily basis. The sickening laws pertaining to the enforcement of student loans is a prime example of how we as Americans are losing our liberties to the wealthy and powerful. How a $100,000 student loan can grow to $200,000 in a free society is beyond me. This is neo feudalism pure and simple. Shall we allow our political structure to revert back to the middle ages or will we move forward and not let the tide of tyranny overcome our will? I find it fitting that the CEO of Sallie Mae corp is named Albert Lord because he has in fact served as lord over hundreds of thousands of student loan borrowers.

Here again is the text of the 13th amendment:

Section 1. Neither slavery nor involuntary servitude, except as a punishment for crime whereof the party shall have been duly convicted, shall exist within the United States, or any place subject to their jurisdiction.

Expanding on the term “involuntary servitude” comes the term “peonage.”

Peonage refers to a person in "debt servitude," or involuntary servitude tied to the payment of a debt. Compulsion to servitude includes the use of force, the threat of force, or the threat of legal coercion to compel a person to work against his or her will.

Interesting how the lenders in this country use the "threat of legal coercion" to force people to work against his or her will. Basically, if a student loan borrower does not work, they will have legal proceedings brought against them which include penalties, fees, wage garnishment, etc.

In conclusion, while it is too soon to begin to take overt action against this hideously corrupt system, what we can do is prepare intellectually, emotionally, physically and spiritually for the battle that lies ahead. In the end, I believe that this generation will prevail against the crimes that are being committed against it.

Take care for now.

This comment has been removed by a blog administrator.

ReplyDeleteActually, in the Middle Ages this usury would've never been allowed.

ReplyDeleteSubprime,

ReplyDeleteI have been following your blog for over a year and have grown to respect your economic predictions tremendously. Is right now a good time to get in on silver, or is it likely that silver will take a break and come down in the next couple of days?

Also, can you give a couple other great commodity recommendations?

Thanks!

Anon @ 9:41 am

ReplyDeleteMany market pros are calling for a reversal in equities come april/may which may also take down the commodity sector. On a fundamental basis, IMO, any price sub $50 is a good price. On a technical basis however, $32 is a bit too steep of a price. For example, the 50 day moving average is currently at $29. I can't give investment advice because I don't have a license but I give out "tips" and pointers.

Study money supply, M0, M1, M2, learn about monetary policy and interest rates. As soon as you have a decent understanding of how our monetary system works it will further your confidence in the precious metals market.

Take care

What would Jesus do?

ReplyDeleteIf a student loan borrower does not work, how does he have any wages to garnish?

ReplyDeleteThere used to be a bar in Kingston, Jamaica called "Sexy Tits". The advertisement for the bar was a drawing in white chalk on a blackboard of a woman with big tits.

ReplyDelete