Corn:

Wheat:

Copper:

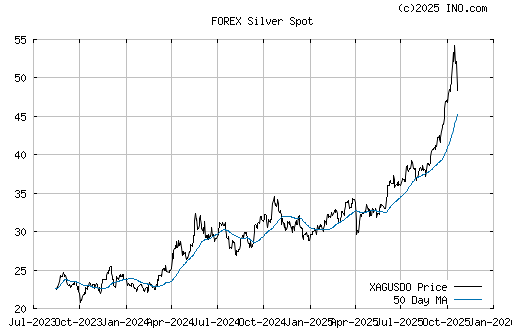

Silver (my personal favorite)

Cotton (WTF!)

Our beloved federal reserve chairman, Ben Shalom Bernanke, recently said that he is 100% certain that inflation can be contained. Here is a excerpt from a recent interview:

Q: What did you see that caused you to pull the trigger on the $600 billion, at this point?

BERNANKE: It has to do with two aspects. The first is unemployment. The other concern I should mention is that inflation is very, very low, which you think is a good thing and normally is a good thing. But we’re getting awfully close to the range where prices would actually start falling.

Q: Is keeping inflation in check less of a priority for the Federal Reserve now?

BERNANKE: No, absolutely not. What we’re trying to do is achieve a balance. We’ve been very, very clear that we will not allow inflation to rise above two percent or less.

Q: You have what degree of confidence in your ability to control this?

BERNANKE: One hundred percent.

You are out of your fucking mind Ben. And yes ladies and gentlement, there is a very strong probability that Mr. Bernanke's monetary experiment will turn out very wrong. While the mainstream media continues to pump out lies about "low inflation" and how it is not a risk, the above mentioned charts prove otherwise. If you are not well versed in monetary matters I highly recommend that you learn ASAP. The internet has a plethora of resources for all to entertain.

And for those who believe that due to the incredible stock market comeback that the economy is following along, observe this chart that depicts US auto sales:

January 2011 auto sales came in at a 12.6 annualized rate, whereas pre-crisis monthly auto sales averaged approximately 16 million units annualized. At current levels auto sales are still down more than 21% from pre-crisis levels. Given that autos and homes are the two biggest purchases that people make in their lifetimes, I find it odd that the economy is supposedly doing "so well" yet these two vital markets are still in the crapper. As rising costs squeeze the hell out of corporate margins, expect further pain to come. And sorry America, its just not possible to print your way to prosperity.

Subprime

Of course, it hurts to pay more for "stuff", but are rising commodity prices really bad news? Historically, commodities have lead the way in economic recoveries. In the year 1900, the USA was a debtor nation, but 20 years later, we were an economic superpower, not because of our stock market, which was flat in those 20 years. But because of commodities. Not arguing against your point, just a little historical perspective.

ReplyDeleteWell on a macro level I weep at high inflation. But then again I have 200k in federal student debt at 8.5% and (currently) no reasonable prospect of paying it off outside of double digit inflation...

ReplyDeleteRising commodity prices are to a large extent due to a substantial portion of the world's population (Chindia) developing at a rapid rate.

ReplyDeleteJust to follow on my 8:18 comment, commodity prices have been rising at just about every currency. Even rising ones like the Aussie dollar. So its not something that is due to American Fed Reserve.

ReplyDeleteI think Bernanke also pointed out that deficit reduction will necessarily consist of either raising taxes, cutting entitlement payments and other government spending, or some combination of both

ReplyDelete