The Lloyd's insurance market and the highly regarded Institute of Strategic Studies (ISS, known as Chatham House) says Britain needs to be ready for "peak oil" and disrupted energy supplies at a time of soaring fuel demand in China and India, constraints on production caused by the BP oil spill and political moves to cut CO2 to halt global warming.

"Companies which are able to take advantage of this new energy reality will increase both their resilience and competitiveness. Failure to do so could lead to expensive and potentially catastrophic consequences," says the Lloyd's and ISS report "Sustainable energy security: strategic risks and opportunities for business".

http://www.guardian.co.uk/business/2010/jul/11/peak-oil-energy-disruption

Subprime: more and more multinational corporations are catching on to the peak oil problem. Unlike global warming where there is heated public debate and discussion, peak oil has remained on the sidelines. It is rarely ever mentioned in American media. Also, in contrast to public awareness regarding global warming, many of the smartest people that I know have never heard of peak oil.

I've noticed a recent uptick in coverage and awareness of peak oil. Lloyd's getting on board is huge because as a insurance company they price in future energy inputs and costs that result thereto.

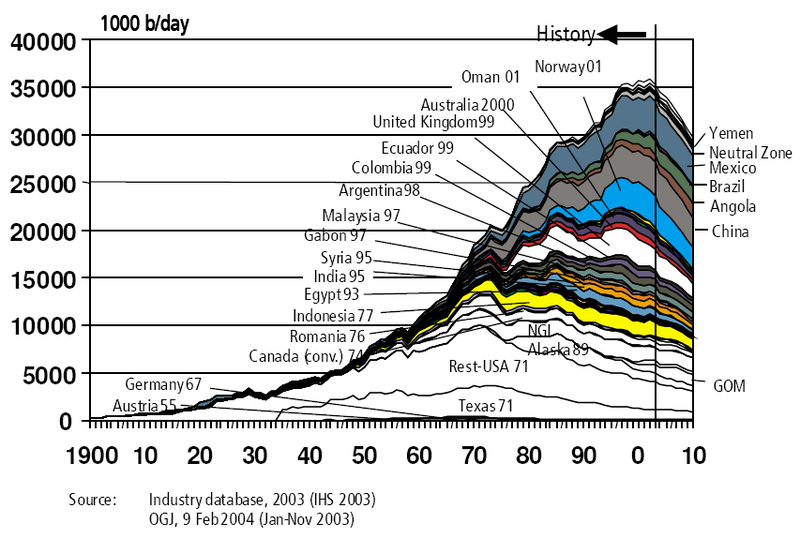

This chart (please click on the photo) shows the production levels of oil producing nations and what year they peaked. Once a nation has hit a peak in production, the decline follows thereafter with decline rates up to 10% per annum. The US has been in decline since 1971.

Forecasts concering the impact of peak oil range from problematic to catastrophic. I am still waiting before I make a personal forecast of my own. Nevertheless, declining oil production at a time when China and India with 2.5 billion people are economically growing at 10% equates to a supply crunch the likes of which the world has never seen. The late 70's oil crunches were politically caused whereas the 2008 oil crunch ($147 crude) and future oil crunches will be geologically caused. Hence, the reason why the US military is presently occupying a nation with over 200 billion barrels of light, sweet, recoverable crude. At the moment Iraq is producing a paltry 2 million barrels per day but the hopes are that the nation will be able to increase its output to over 8 million barrels per day. Its been 7 years since the invasion and still production levels are sub 2002 levels.

Here is the latest chart from the IEA and it doesn't look good.

In addition, when you add in the fiscal and monetary woes the world is currently experiencing, peak oil seems like the final nail in the coffin. The US is highly exposed to higher oil prices as America consumes 22 million barrels per day out of the global production of 86 million bpd.

States and cities are broke, the banks are busted and are only surviving as going concerns due to false accounting rules. The federal government is blowing through 1.5 trillion dollar deficits for the second year in a row. Interest rates are held at 0 by the US central bank in the hope that somehow, someway, the economy will take off again. When we have massive institutions like Lloyd's pricing in the effects of peak oil, our true woes are only beginning.

I hate to be so fucking pessimistic, but now is the time to look at REAL FACTS, and not just smoke and mirrors.

No comments:

Post a Comment