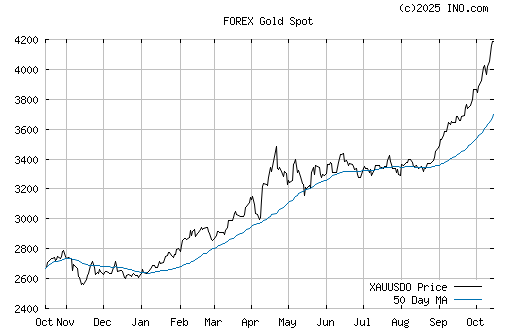

Gold 1 year chart:

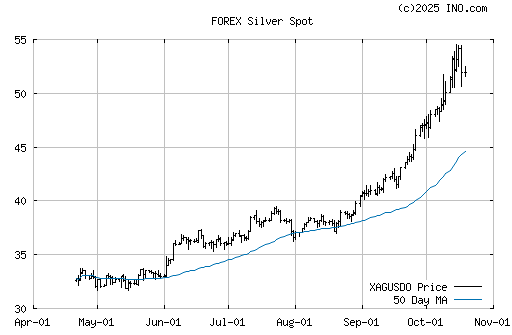

Silver 6 month chart:

Naturally the policy makers will come to the rescue as Italy is without a doubt “too big to fail” and so the ponzi will continue. Just as the republicans put up a little fight over the debt ceiling but ended up capitulating, so will the Germans who publicly oppose the subsidization of their southern buddies. There will come a point where the European Monetary Union will unravel as it is completely unsustainable for 17 separate countries to operate under a common currency with similar central interest rates but no central fiscal funding mechanism. However, the Eurocrats have fought hard for their beloved Union and will not go down without a fight. This monstrosity may last longer than most believe as powerful vested interests have billions at stake in keeping the EU together. Perhaps Greece and Ireland will get the boot at some point soon.

Italy 10 year government bonds:

In response to all this news gold jumps higher and will continue to rise as currency debasement has become in vogue across the developed world. Gold also jumped when that pesky little critter Bernanke uttered words that “in the event that conditions are such that accommodation may be required, the federal reserve is willing to provide additional monetary support and accommodation.” In other words, QE 3. Upon the official pronouncement of the third round of monetary easing the precious metals will be set to rally hard. And they will rally again on the 4th, 5th and 6th rounds of easing until we enter a new paradigm regarding international transactions and what the pricing mechanism will be. Already we are seeing gold rise to its historical position of reserve currency.

Left out of this discussion is the effect that future easing will have on the oil market. Although it’s possible that the Middle East conflicts could calm down it is equally possible that a larger conflict erupts involving bigger players such as Saudi Arabia and Iran. For example, the Kingdom of SA has increased military spending to over 11% of GDP and has been getting armed to the teeth with the KSA ranking in the top 10 countries in the world for military spending. Not that I see any armed conflict between these two regional powers breaking out anytime soon the potential is there. And there is always the potential for a Iran-Israel air war which could break out if Israel engages in a pre-emptive strike on Iranian nuclear sites. Per ex-CIA Robert Baer, "There is almost "near certainty" that Netanyahu is "planning an attack [on Iran] ... and it will probably be in September before the vote on a Palestinian state. And he's also hoping to draw the United States into the conflict."

http://www.zerohedge.com/article/cvn-77-ghw-bush-enters-persian-gulf-cia-veteran-robert-baer-predicts-september-israel-iran-w

In the event of a Iran-Israel war, even if short lived, could easily send the oil market in a tizzy as we could potentially see $150 crude sinking the world economy back into recession. This is a tail-risk that needs to be closely watched. I have had a Iran-Israel conflict on my list of potential tail-risks and this recent report definitely raises the scales.

But back to the oil market more monetary easing will simply translate into higher energy prices which will then push the prices of everything else higher. Lastly, there are serious supply issues that will need to be addressed in the next decade as supply constrains will act as a further tailwind for energy prices.

To this day the majority of the wealthy people that I know own virtually no gold or silver holdings. Faith in paper currency is practically as strong as it was a decade ago but there are cracks appearing in the fiat edifice. Many are hesitant to buy at these lofty levels but the point is not to see the value of gold against the dollar but the value of the dollar and all paper currency against gold. I reiterate my call for $5,000 gold and $100 silver.

Lastly, the law school bubble continues to blow upward with law school applicants acting as momos (momentum chasers). These fools are buying into a extremely overpriced product that has deteriorating fundamentals (jobs and wages) just because of legacy value and confirmation bias. I still hold the view that the bubble will bust when the funding source (the department of Education) cuts the money spigot as younger aged Americans are simply too naive to see the risks inherent this market. Although quality applicants will fall in number to lower tiered schools, there are plenty of people out there that are willing to "give it a shot" and take the plunge. At least when I applied in 2005 there wasn't much information about the TTT world. Enter 2011 and the net is inundated with articles and blogs bemoaning the dismal state of the legal market for TTT grads. Just typing in tier 4 law school in google will show hundreds of articles and message boards warning people not to attend. At this point the information is there.

Thanks for letting us know! That's interesting to know. Our custom writing companies are aimed at facilitating the educational process of every particular customer.

ReplyDelete