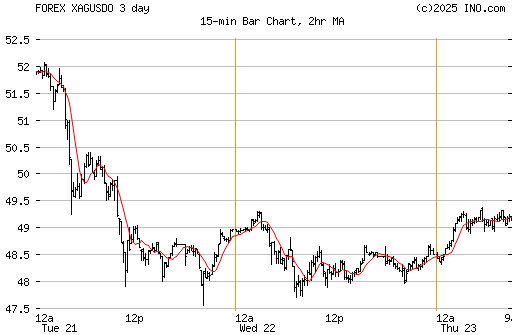

Observe the bloodbath in spot silver:

Currently trading at $43.52, hit a trading session low of $42.10, down from its recent high of $49.50.

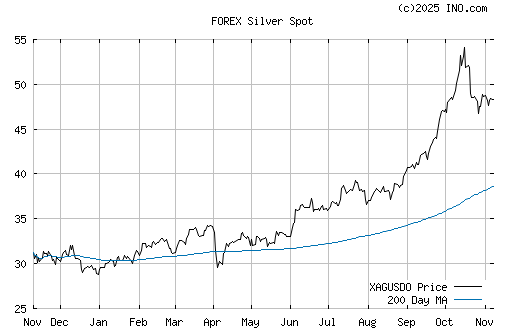

This longer term chart shows current price and the 200 day moving average:

Notice how the 200 DMA is at $30 while current spot is at $43.50. Just last week with a $49.50 price there was a nearly $30 premium over 200 DMA, or close to 100%. A quick definition of the 200 DMA: This is one of the most popular averages used by traders and investors. It is arrived at by taking the closing price of a stock or commodity, for the past 200 days, and adding these up, then dividing by 200.

No one knows what the hell markets will do in advance but there are some useful indicators that can assist one in making a educated guess. In the end all investors are speculators to some extent. The same can be said about college grads as they take on risk (loans, loss of time) while betting that with their degree they will be able to earn more. Me personally, I've been holding off on any metals purchases until a correction came. That was my guess and so far so good. Of course the recent rally can continue so my theory can go to shit. Still holding off until silver drops to the mid 30's, maybe even lower. Time will tell but I'm waiting until the end of QE2 on June 30 to see how markets will react. So far, big investment heads are saying volatility will rule for Q3 and Q4 and I agree with their assessment.

On a final note, when playing with markets I never bet the house (or my life savings). My core silver and gold holdings were purchased several years ago and are viewed as insurance on my savings and not as a tool for trading. Hopefully this correction continues into the summer providing a good buying opportunity.

Have a good week everyone

A lot of commodity prices are sinking after a market fueled high, including the price of oil.

ReplyDeleteThis is Teacher Appreciation Week.

ReplyDeleteHow 'bout some free beer for the Teacher?

Can we get some free beer for the Band, please?!

This is Teacher Appreciation Week.

ReplyDeletehttp://www.teacher-appreciation.info/Teacher-Appreciation-Week-2011/

I heard that to celebrate Teacher Appreciate Week Hooters is giving all Teachers, including Law School professors, a 2-for-1 special on drinks all this week.