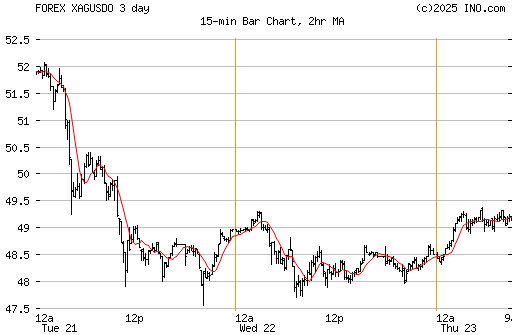

Silver breaks into the $40 level

Crude oil crosses the $110 level

And finally the US Dollar Index, which is an index of the value of the US dollar relative to a basket of foreign currencies. The currencies are the Euro, British Pound, Japanese Yen, Swiss Franc, Swedish Krona and the Canadian dollar. The Euro has a 56% weight in the index. Observe the freefall in the USDX.

The all time low on the USDX is 70.69 which occurred in March of 2008. Many analysts are calling for new lows on the USDX in the not too distant future. In addition, many say that the USDX is flawed because it measures the dollar against other fiat currencies, especially the Euro with it's huge weighting. Whereas the euro/dollar may trade at similar levels to each other, they could also be losing value AT THE SAME relative to real products.

Nevertheless, this is a glimpse of what happens if we were to ever have a US dollar crisis. The prices of things that are priced in dollars would skyrocket to the moon. Already crude is priced over $111 which is complete insanity. Obviously there are supply issues with Libya and Middle East concerns but a good 20% of the price premuim is dollar weakness related. Silver and gold continue to act like fucking shitheads and continue moving higher. Right now the panic has to do with the potential US government "shutdown" that is freaking out the markets. I'm confident that a resolution will be passed shortly and the federal debt level will be raised to $16.5 trillion which will buy us a good year and a half at most. When and if this sucker will go down I don't know but the signs are there for everyone to see that something is definitely wrong. On a techncal level our country is broke. It just depends on when people want to accept the fact.

Oh and just a photo...

Peace

Shaking my head at your delusionary ideas that the powers-that-be are going to allow their bonds to be inflated away thereby relieving the debtors of their burdens. If your car breaks down unexpectedly and your expenses rise that year as a result, or your wife divorces you and you are stuck paying alimony and thus having increased expenses for life, is either of those cases inflation? Of course not. Inflation is always and everywhere a monetary phenomenon. If there is inflation, then all prices go up, including wages, other than prices fixed by contract. Note that prices fixed by contract includes the all important debts. Wages are going nowhere, and therefore there is no inflation, other than the inflation the Fed wants, regardless of what is happening with commodities.

ReplyDeleteThe Fed is printing money so as to achieve the Fed's targeted inflation rate. The fall in the dollar is desired by the Fed to stimulate the economy. If and when inflation gets too high, the Fed has an immense arsenal of bonds it can sell to raise interest rates back up and unprint most of the money it has printed. The Fed is controlled by the powers-that-be in this country, the wealty, and it will not let them be destroyed. The Fed caused a horrible recession in 1980-82 in order to break inflation then, and the country was far more liberal, youthful, and with a much lower private debt burden and much less concentration of wealth then than now. Conservative, aging societies, with power vested in the hands of bond-holders do not tolerate inflation and they will stop it if possible.

What you have to fear is not inflation, but rather the rise in interest rates that will occur when true inflation (marked by a rise in wages) finally becomes a threat. When interest rates rise, the dollar will also rise, while asset prices (including stocks, bonds, gold, commodities, real-estate) fall, causing a negative wealth effect. The fall in gold, agricultural commodities and perhaps stocks will amount to a crash. The government can and will eventually impose a VAT (national sales tax) to penalize consumption by the lower echelons, and it can make huge cuts to medicare/medicaid and the social security disability scammers, big cuts in defense. Think this won't happen? Look at what the states are doing for a taste of what the Feds will eventually do. Lots of ways to control inflation, if the powers-that-be want to control inflation. And they do, because they are the people who own Sallie Mae bonds. They will not allow the value of those bonds to be inflated away. (A small loss on bonds due to rising interest rates at the short-end of the yield curve will be tolerated. What the Fed giveth by lowering rates, it taketh back by raising them later. What matters to the wealthy is to keep the long-end of the yield curve from rising too much.)

You will not be bailed out. Sorry.

Bailed out of your student loan debts by inflation. Important to be very precise, since I know your delusionary mind will do anything to avoid facing reality.

ReplyDeleteDid it again. (Maybe there is something in my subconscious that causes me to omit details?) Final version:

ReplyDeleteYou will not be bailed out of your student loan debts by inflation. Sorry.

To anon:

ReplyDeleteYou said,

"Shaking my head at your delusionary ideas that the powers-that-be are going to allow their bonds to be inflated away thereby relieving the debtors of their burdens"

AND

"Bailed out of your student loan debts by inflation. Important to be very precise, since I know your delusionary mind will do anything to avoid facing reality"

You should do your due diligence before assuming such things. I have stated time and time again that student loans are not an issue for me (thankfully). In fact I owe 19k on a 10 yr plan min payment of $250 of which I pay $400 per month, sometimes even 1k depending on bonus. Thus, my positions are not based on delusions to avoid my supposedly indebted reality.

You also said,

"Wages are going nowhere, and therefore there is no inflation, other than the inflation the Fed wants, regardless of what is happening with commodities"

It is true that private sector wages are going nowhere, but you fail to account for FEDERAL spending which now comprises nearly 28% of GDP. Of the 4 trillion the gov spends, over $1.5 trillion is borrowed and PRINTED into existence. Thus, when the USDA deposits up to $85 billion per year in peoples accounts for food stamps, that is PURE inflation. When the federal gov spends money of which the source is the federal reserve's monetization activities on medicare, social security and defense, that is PURE inflation. When the federal gov allocates money towards student loans thereby increasing the price year after year, that is pure inflation. Henceforth, while private wages may be in the toilet, the biggest spender, the federal gov, is ramping up spending which gets spent into the economy. Pure inflation.

In addition, dont forget that hyperinflation has occured in many nations where unemployment was terrible. Strong employment is NOT a necessary condition for hyperinflation. Just take a look at Argentina, Zimbabwe, Germany, Yugoslavia and many other countries that have experienced hyperinflation. They all had high unemployment but still experienced terrible inflation.

The fed and its goons love to talk about demand push inflation, which involves increasing wages causing higher prices. What they never talk about is COST push inflation. What we are experiencing is a combination of both, due to federal gov spending AND commodity price increase due to 0 percent interest rates and a flood of money chasing limited goods.

You also said,

"The fall in the dollar is desired by the Fed to stimulate the economy. If and when inflation gets too high, the Fed has an immense arsenal of bonds it can sell to raise interest rates back up and unprint most of the money it has printed".

Total debt is roughly $52 trillion. Total debt to GDP is close to 400%. Go ahead and watch chairsatan Bernanke raise rates to 10% and see what happens to the capital markets. Watch what happens to federal gov interest expenses as a percentage of federal revenues.

In the end, whether by nominal or real spending decreases, defense, social security and medicare will be reduced. This is what happens when a nation goes broke. The issue is whether the currency gets obliterated. I'm not as confident as you that the powers that be will be able to control the ponzi. Hence the reason for my precious metals holdings.

email me at darkktrader@gmail to discuss further if you'd like

Inflation in wartime or anarchic societies that you mentioned is largely psychological. In the USA, despite the lack any of the ingredients for inflation, there is more than a 0% chance of inflation, but it should not be near the top of the list of fears.

ReplyDeleteUnions are weaker in the USA than they have been since before the Great Depression.

And the "costs" you cited are minimal. Have you ever actually tried to live on food stamps? The USA could give food stamps to everyone in the nation and it still would have no impact on inflation.

The federal expenditures in the USA are not inflationary. The risk of inflation would have been there if the USA had implemented a true stimulus bill, focused on infrastructure construction/repair, similar types of projects, and jobs. The risk with these types of programs is that, when the economy begins to recover, the government must trim back its efforts, or else the twin pressures will drive inflation.

The annual deficits may seem large but they are insufficient to rekindle the economic engine. And they have been spent on the wrong things. The USA, while initially saying in 2008 that it would avoid all the mistakes Japan made in the 1990s, then proceeded to repeat many of them.

It is a tough situation. Cutting the deficit will crush the recovery and send unemployment higher. Those who advocate cutting the federal budget use the following reasoning: driving up unemployment to 20% will drive wages down to third-world levels which will spur businesses to begin massive hiring. This may possibly ensure that profits remain at record levels but it will eviscerate the middle class. The USA economy is dependent on consumer spending by average families. It is not clear at all whether it is realistic to turn back the clock to an era when consumers played a very minor role in the national economy.

The main problem is the shift 30 years ago from dependence on fiscal policy to dependence on monetary policy. Monetary policy is driven by the Fed. Although nominally the Fed has a secondary goal of minimizing unemployment, its primary focus (and took kit) are for minimizing inflation.

Right now the main tools for the Fed to restrain inflation are to raise the benchmark interest rate and to roll back quantitative easing. (By no means has anyone been "printing money.") As we have seen since 2001, in the modern economy, the Fed's interest rate lever provides limited effectiveness in stimulating and de-stimulating the economy. At best, the Fed influences 30-day and 90-day interest rates. Many types of lending are tied to 10-year interest rates; this includes mortgage lending. Short-term and medium-term and long-term rates don't always move in concert.

If the conservatives' theories of economics are correct, the best fiscal tool to restrain inflation would be to increase taxes when the economy shows early signs of overheating.

College tuition is a very small share of the national economy and has been increasing quickly in all parts of the economic cycle for many decades. Direct loans, far from adding to the national debt, are assets for the taxpayer. Think of it as a bank. Banks have been making loans for hundreds of years. Those loans are assets on their books, not liabilities. A bank which lends a company $50,000 has not just taken a loss of $50,000. Banks calculate the future positive and negative cash flows stemming from each group of loans. This includes budgeting a loss reserve allocation. Everyone and her brother wants to own a bank, because this business is quite profitable. In addition, the federal government has additional collection tools not available to banks.

"Total debt is roughly $52 trillion." It is $14 trillion for the federal government. You must be counting estimates of future obligations, which, in a true budget, would be less, where the capital budget would be separated from the operational budget. In any case, moving the goal posts is not credible. The level of debt is less, in relation to the size of the economy, than it was during WWII.

ReplyDeleteIf the economy is strong enough to sustain federal budget cutting, then it is strong enough for steep federal tax increases. Federal taxation is at a 60-year low.

Total debt is in fact $52 trillion. Here is my source:

ReplyDeletehttp://www.federalreserve.gov/releases/z1/Current/z1r-4.pdf

From the federal reserve flow of funds which is released 4 times a year. On page 60 (the link takes you there) it shows total credit market debt outstanding at $52.6 trillion. It breaks it down by sector. Federal gov debt by marketable securities is $9.3 trillion, with the remainder being intragovernmental holdings (SS, Medicare).

In the 30's gov debt was higher as a percentage of GDP but households and companies were in the process of severe deleveraging. This time households, corporates and the GOV are leveraged to the hilt. While households are in the process of delevering, the gov is taking it upon itself to make up the shortfall.

I don't buy into the position that gov spending is not inflationary but that discussion is another time (going out with the wifie). If possible try posting under a name as I appreciate your knowledgeable posts.

Anonymous, just curious. What do you do for a living, and where are your investments?

ReplyDeleteI think the answers will highly explanatory of your mindset.