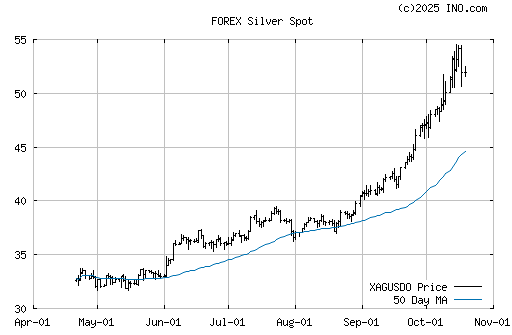

I continue to be amazed by silvers performance. A correction is long overdue on a technical basis but as Keynes said it best, "the market can stay irrational longer than you can stay solvent." However, the fundamentals for silver continue to get better as Portugal is the latest European country on the verge of sovereign debt default. As Portugal's government debt continues to sink in value, thereby raising borrowing costs which further increases funding risks, the European Central Bank (ECB) will likely come to the rescue with freshly printed euros. Hence why the US stock market didn't even flinch on the news of a imminent government collapse. In addition, parliament voted down the austerity package which logically introduces the bailout option (i.e. printing of euro option), thereby sending silver to the moon.

When the currency debasement comes to an end, the precious metals market will finish its incredible run. However, if the presses continue to run at these rates, there is no limit to how low paper currency can fall against the monetary metals.

Here in the South, we've always know that when the Yankees come you can always bury the silverware in the back field.

ReplyDelete