Dying of Money

Lessons of the Great German and American Inflations

Jens O. Parsson

(1974)

This is from chapter 3: The Gains and Losses

When the inflation was over, everyone who had owed marks suddenly and magically owed nothing. This came about because every contract or debt that called for payment in a fixed number of marks was paid off with that many marks, but they were worth next to nothing compared with what they had been worth when they had been borrowed or earned. Germany’s total prewar mortgage indebtedness alone, for example, equal to 40 billion marks or one-sixth of the total German wealth, was worth less than one American cent after the inflation. On the other side, of course, everyone who had owned marks or mark wealth such as bank accounts, savings, insurance, bonds, notes, or any sort of contractual right to money suddenly and magically owned nothing.

The largest gainer by far, because it was the largest debtor, was the Reich government. The inflation relieved it of its entire crushing debt which represented the cost of the war, reconstruction, reparations, and its deficit-financed boom. Others who were debtors emerged like the government with large winnings. Until the last moment of the inflation borrowers continued to make huge profits simply by borrowing money and buying assets, because lenders never stopped underestimating the inflation. The good fortune of the debtors demonstrated the prudence of following the government’s lead: one must beware of being a creditor whenever the government was a huge debtor. Farmers in particular were the classic case of invulnerability to inflation, because they always had food, their farms were constant values, and the many who had mortgages on their farms were forgiven their debts outright.

The debtors’ gain was the creditors’ loss. Foreign holders of marks were huge losers. Germany was estimated to have made a profit of about 15 billion gold marks, or 40% of its annual national product, on sales of its paper marks to foreigners, even after deducting reparations payments. The wealthy in Germany suffered heavily but unevenly; the more nimble perceived early enough the need to invest in something other than mark wealth, while those who were not nimble lost everything. Trustees were forbidden by law until the very end to invest in anything but fixed obligations and consequently lost all the value of their trusts. The endowments of great charitable institutions, similarly invested, were wiped out. Financial institutions such as banks and insurance companies, which were both debtors and creditors in marks, were generally weakened though not destroyed in the inflation because of their inability to see clearly what was happening. Speculators tended to believe in their own game until too late and emerged as net losers. Sound business escaped weaker but intact; their debts were relieved but their boom business was gone. Inflation-born businesses disappeared.

Industrial stocks, the darling of the inflationary speculation, had a peculiar history. At the height of the boom, stock prices had been bid up to astronomical price-earnings ratios while dividends went out of style. Stock prices increased more than fourfold during the great boom from February 1920 to November 1921. Then, however, shortly after the first upturn of price inflation and long before the inflationary engine faltered and business began to weaken, a stock market crash occurred. This was the Black Thursday of December 1,1921. Stock prices fell by about 25% in a short time and hovered for six months while all other prices were soaring. The real value of stocks declined steadily because their prices lagged far behind the prices of tangible goods, until for example the entire stock ownership of the great Mercedes-Benz automobile manufacturer was valued by the market at no more than 327 cars. Investors were extremely slow to grasp that stocks were poles apart from fixed obligations like bonds, quite wrongly thinking that if bonds were worthless stocks must be too. Nearer the end in 1923, relative prices of stocks skyrocketed again as investors returned to them for their underlying real value. Stocks in general were no very effective hedge against inflation at any given moment while inflation continued; but when it was all over, stocks of sound businesses turned out to have kept all but their peak boom values notably well. Stocks of inflation-born businesses, of course, were as worthless as bonds were.

The mass of the workers who lived mostly on their current wages, and who had no savings to lose, suffered only temporarily with privation and unemployment in the very last throes of the inflation; but these problems passed and left them where they had been or not much behind. To them, the agony of the inflation was largely someone else’s, just as the boom had been.

At bottom, it was the unsuspecting middle class who were Germany’s savers, pensioners, purchasers of life insurance, including everyone from workers who saved to the modestly well-off, who not only suffered the worst of the agony while the inflation lasted but also were left after it was over with the most staggering permanent loss in relation to their whole substance. This class paid the piper for all of Germany. Great numbers of pensioners were left totally impoverished and forced back into the work gang to end their days there. The encouragement to thrift, an old German weakness, turned out to have been a complete swindle. Instead of a levy on all the Germans to pay for Germany’s indulgences, a levy which might have been heavy but could have been fair, Germany left the levy to fall on those who were too innocent to evade it, and from them it took everything they owned. In any case, it was not the piper who went unpaid.

The effect was a confiscatory tax on these victims. John Maynard Keynes, who later rightly or wrongly was adopted as patron saint by inflationary governments, excoriated them on this occasion:

“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they can not only confiscate, but they confiscate arbitrarily … “

Adolf Hitler, whose economics were far more astute than those of the government’s economists, shared roughly the same view of the inflationary government confiscators with Lord Keynes:

” … once the printing presses stopped—and that is the prerequisite for the stabilization of the mark—the swindle would be at once brought to light … the State itself has become the biggest swindler and crook.”

Despite the obliteration of the wealth of millions of individual Germans, the inflation was merely a transfer of their wealth, like any tax, and not in any sense a destruction of wealth. For every German’s total loss, there was an equivalent gain to some other German debtor or to Germany as a whole, through the discharge of their debts.

The link to the entire book online

http://www.delanion.com/main/dom.htm#c03

And of course for some charts:

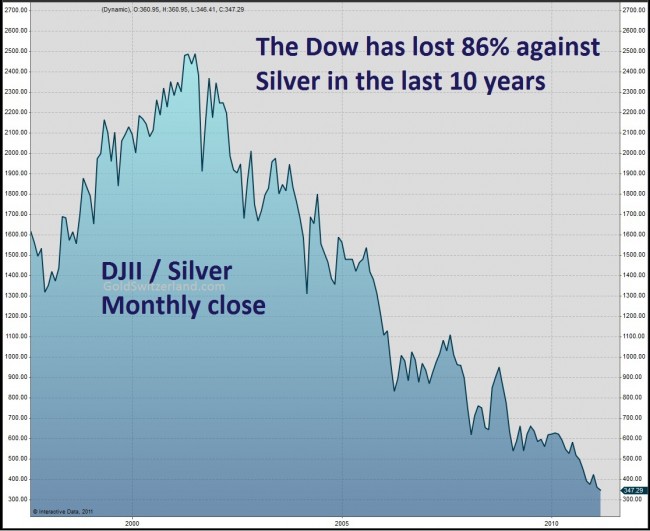

The Dow Jones priced in silver:

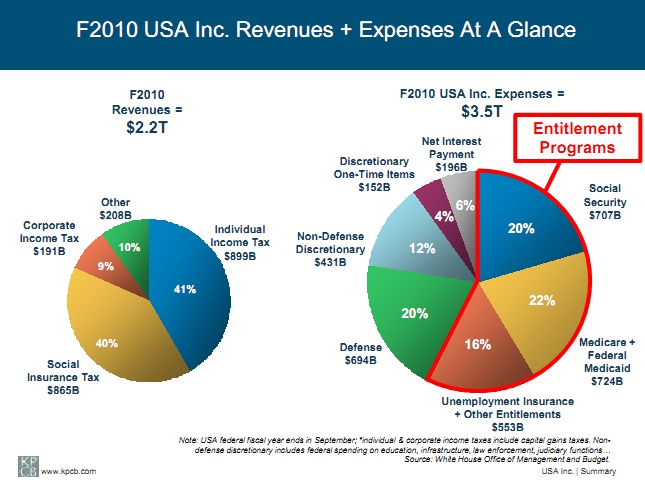

The US federal budget with revenues and expenditures:

Week after week famous market pros are ringing the alarm bells of the risk of severe inflation hitting the United States. I suggest we start stock piling the essentials in the event of a inflationary storm. Better to be a year early than a day late.

Peace

Run for your lives!

ReplyDeleteRepent!

The end is nigh!

This is why i read subprime!

ReplyDeleteThanks for the education!

It is fascinating to learn about how hyperinflation can shift wealth from savers to borrowers.

ReplyDelete