Algeria oil production:

2008 2,173,000

2009 2,173,000

2010 2,125,000

Iran oil production:

2008 3,800,000

2009 4,000,000

Saudi Arabia production:

2009 7,300,000 (exports)

Libya oil production

2009 1,600,000

Production problems in Libya alone have caused crude to spike to $99.50. Just imagine when the unrest spreads to the big producers. If you are not well acquainted with the theory of peak oil, now is the time to learn about one of the most important issues of our generation.

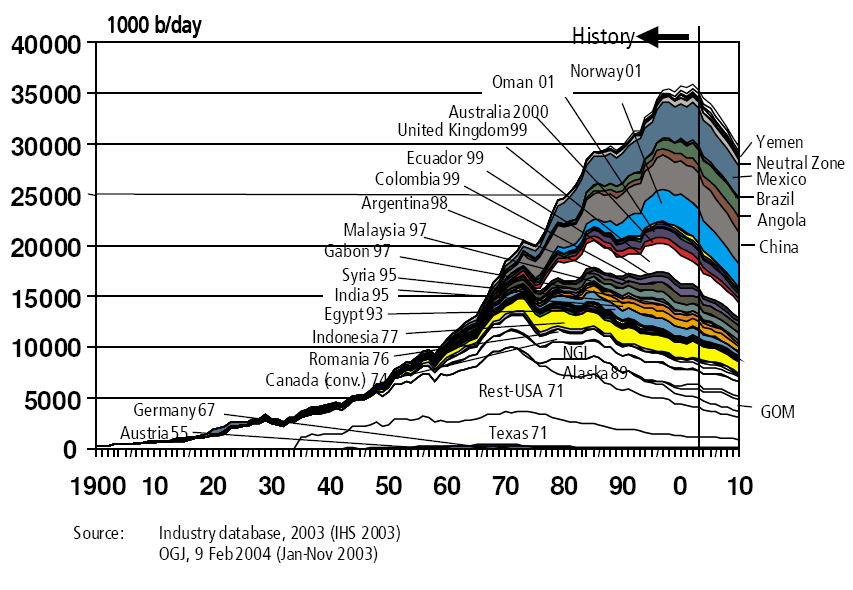

Peak oil charts:

Oil discoveries:

An intro to peak oil from Wikipedia:

Peak oil is the point in time when the maximum rate of global petroleum extraction is reached, after which the rate of production enters terminal decline. This concept is based on the observed production rates of individual oil wells, and the combined production rate of a field of related oil wells. The aggregate production rate from an oil field over time usually grows exponentially until the rate peaks and then declines—sometimes rapidly—until the field is depleted. This concept is derived from the Hubbert curve, and has been shown to be applicable to the sum of a nation’s domestic production rate, and is similarly applied to the global rate of petroleum production. Peak oil is often confused with oil depletion; peak oil is the point of maximum production while depletion refers to a period of falling reserves and supply.

M. King Hubbert created and first used the models behind peak oil in 1956 to accurately predict that United States oil production would peak between 1965 and 1971 His logistic model, now called Hubbert peak theory, and its variants have described with reasonable accuracy the peak and decline of production from oil wells, fields, regions, and countries, and has also proved useful in other limited-resource production-domains. According to the Hubbert model, the production rate of a limited resource will follow a roughly symmetrical logistic distribution curve (sometimes incorrectly compared to a bell-shaped curve) based on the limits of exploitability and market pressures.

Some observers, such as petroleum industry experts Kenneth S. Deffeyes and Matthew Simmons, believe the high dependence of most modern industrial transport, agricultural, and industrial systems on the relative low cost and high availability of oil will cause the post-peak production decline and possible severe increases in the price of oil to have negative implications for the global economy. Predictions vary greatly as to what exactly these negative effects would be. If political and economic changes only occur in reaction to high prices and shortages rather than in reaction to the threat of a peak, then the degree of economic damage to importing countries will largely depend on how rapidly oil imports decline post-peak.

Optimistic estimations of peak production forecast the global decline will begin by 2020 or later, and assume major investments in alternatives will occur before a crisis, without requiring major changes in the lifestyle of heavily oil-consuming nations. These models show the price of oil at first escalating and then retreating as other types of fuel and energy sources are used.[4] Pessimistic predictions of future oil production operate on the thesis that either the peak has already occurred, that oil production is on the cusp of the peak, or that it will occur shortly. The International Energy Agency (IEA) says production of conventional crude oil peaked in 2006. As proactive mitigation may no longer be an option, a global depression is predicted, perhaps even initiating a chain reaction of the various feedback mechanisms in the global market that might stimulate a collapse of global industrial civilization, potentially leading to large population declines within a short period.

It is extremely important that you learn about peak oil as it will have profound implications for our world and our lives.

UPDATE: due to the debate that this post has stirred I have posted 3 videos from Dr. Martenson's website, Chrismartenson.com. Dr. Martenson is the author of the crash course which discusses the theory of peak oil in great detail. I recommend that the crash course is watched in its entirety. Here are the clips:

Subprime

I think this stuff is all so overblown. I wonder if oil consumption has gone up over the last couple of years (while the recession has dampened demand I am guessing that the BRIC countries may have made up the difference).

ReplyDeleteOil at $100 opens up a whole new supply of alternative drilling and even alternative energy as a viable substitute. You won't see a rush to this though because of the capital requirements and long lead times. Oil would have to stay consistently above this mark.

I think the issue with oil is that what is produced is very close to what is consumed. In the short term, the demand is pretty inelastic. So a small drop in supply will spike the price. Also, a drop in demand like the recession will crater the price.

I'm not saying oil won't hit $200 a barrel before this is over, it just won't stay there.

See the movie "Inside Job", about corruption on Wall Steet. It includes a short segment on the rise in college tuition and student debt.

ReplyDeletePeak oil is a myth.

ReplyDeleteI love how you post information as if you've unearthed some secret for the unaware who are at some grave risk.

Thanks for the chuckle.

http://www.energybulletin.net/stories/2010-11-11/iea-acknowledges-peak-oil

ReplyDeleteThe link speaks for itself.

bro wtf? Is this an unemployed lawyer blog or a finance blog. Stick to loans, or better yet, open another blogging account.

ReplyDeleteJust saying...

@ 7:59pm

ReplyDeleteI talk about important issues of the day, including but not limited to the law school scam. Why does everything have to be so niche?

Globalism:

ReplyDeletehttp://www.abajournal.com/news/article/the_job_market_is_tough_for_law_grads_in_china_too/

In my opinion, peak oil is a myth as described by Lindsey Williams.

ReplyDelete@ 6:27 am

ReplyDeleteThanks for the support. I'm glad that some people out there can see the bigger picture.

Love your blog! keep up the good work, and thank you for taking the time to share such important information. You may be interested in a great site called the Globalization research center. Check it out.

ReplyDeleteThat first chart doesn't make much sense. Peak oil hit at 70m barrels per day of production, not 36. Also, the projected fall-off is completely wrong: we've been on a plateau since 2005 with a bit of downward slant, not the steep plunge projected on that chart. A much better chart is the revised production expectations of the EIA:

ReplyDeletehttp://s777.photobucket.com/albums/yy52/TheDudePeakOil/?action=view¤t=EIAIEOOilProjections2000-2010.png

Their 2001 production projection for 2015 is now their projection for 2035. I'm guessing we never get near that 2035 projection.

Search Wikileaks. There was a recent release which indicated that Saudi Arabia was overstating its supply.

ReplyDelete[Muumar Gaddafi]

ReplyDeleteThere was a girl...

ROCK MY WORLD...

She was a pearl...

ROCK MY WORLD...

Golden hair and curls...

ROCK MY WORLD...

Her tits could twirl...

ROCK MY WORLD....

[Wall Street Theme Song]

ReplyDelete"Oh...a Yo Ho Ho...

And a bottle of Rum...

A Pirate's Life for Me!!!"

Hi Subprime,

ReplyDeleteBy any chance would you consider changing the name of your blog to something like this:

Subprime JD: A forum to discuss the global economy, the student loan dilemma and life as a recent law school graduate.

Thanks,

LWIC

LWIC:

ReplyDeleteI agree that the intro to the blog needs to be changed. I've been thinking of a good intro for a while now.

I don't think your blog is really focused on the legal profession. Why don't you change the name from subprime jd to commodities JD?

ReplyDeleteHi 8:07,

ReplyDeleteI am really not an unpleasant person. I am just trying to encourage moving focus to universal issues and not indulging in tier discrimination.

Thanks,

LWIC

You people are fucktards. It's amazing that you are able to look at realty in a vacuum.

ReplyDeleteI find it commendable that someone who actually went through law school is able to speak the language of the oppressors (jibber jab of finance/commodities). It's incredibly impressive.

WAKE THE FUCK UP and realize that this world is slowly imploding--and those in privilege will be ousted from their thrones and oligarchy will no longer be the tolerated. And yes. We Have An Oligarchy In The US.

Peak oil and the student loan crisis are but two of the very important catalysts that will ignite the flame here in the states.

"speak the language of the oppressors" - 8:33

ReplyDelete*chuckle*

Someone's reading too much conspiracy literature.

How is going from massive student loans to peak oil healthy or helpful? It's a slippery slope to make the logical connection from dismal job market to the evil powers that be. Again, how is this paranoia helpful?

Unless you have a trading account and betting on multiple derivatives to make a living, this would not be helpful. Especially for someone with a 200k student loan who will be in bondage for the rest of his life who fantasizes one day to make a green positive dollar.

Stick to student loans, JD. Write a story about its implications to the domestic economy or something like that and we'll eat that shit up.